11 Ways to Save Money on a Tight Budget

If you’re like the majority of people, saving money can be hard. There always seems to be a bill to pay, a vehicle to fix and groceries to buy. It’s all part of living.

Luckily there are ways to save money on a tight budget and still have room to treat yourself. We’ve put together 11 simple ways you can save money each month so you can put your worries aside and watch your savings grow!

First—let’s get down to basics

When you start saving money, there are two essential things you should do before any other planning:

1. Know your income and monthly expenses

If you know exactly how much money will be coming in each paycheck, you’ll be able to budget accurately and avoid spending what you don’t have. You should also look at your last month of expenses and note how much you’ve spent on what. If it helps, break your spending into categories like groceries, rent and entertainment. You can track your expenses in an Excel spreadsheet or on a budgeting app like Mint. Once you compare how much you make to how much you spend, you’ll have a better idea of where you need to cut down.

Read more: How to Maximize Your Tax Return

2. Create a budget spreadsheet

After you’ve evaluated your income and expenses, you can create your budget! A great way to set up your budget is using the 50/30/20 rule:

- 50% of your income should be spent on needs. These would include expenses like rent or your mortgage and groceries.

- 30% of your income should be spent on wants. This could include eating out for dinner or TV subscription services.

- 20% of your income should be put towards savings and/or investments. Whether you’re contributing to an RRSP or saving for a house, it’s always a good idea to put some money away each month.

If you allot money for these categories, you’ll be well on your way to saving. The best part is you can adjust as you go—you’ll figure out what’s realistic for you and you can always modify your budget as time goes on.

Read more: Top Budgeting Apps for Canadians

Tips for living on a budget

So you know how much you make, you know how much you spend and you’ve created a budget. But maybe you’re still spending a bit more than you planned for. Here are some easy ways to save money on a tight budget that won’t require a huge lifestyle change!

3. Use a savings bucket strategy

This tip is more about how you organize your savings and it’s super helpful. When you’re planning your savings, create buckets or “themes” for items or experiences you’re saving for. It could be vacations, a new computer, a car maintenance fund or monthly contributions to an RRSP. If you want to contribute to multiple savings accounts at once, creating buckets is a great way to manage your contributions and monitor your progress.

4. Have a saving partner

If you decide to save with someone else, you can motivate and keep each other accountable. Even if your goals are different, it helps to have someone you can share your thoughts and successes with (and lift each other up when you need it).

5. Look at your fridge before grocery shopping

When you grocery shop without a goal, or on an empty stomach, chances are you’ll come home with more than you actually need. Have a look at your fridge and freezer before you make the trip. Make a list of the essentials you need and think of some meals you’ll want to cook throughout the week. If you only buy what you need, you’ll save money each month and waste less food—it’s a win-win!

6. Eat and make your coffee at home

This ties into the above grocery tip. The more you eat at home, the more money you save. Eating out at restaurants is far more expensive than buying groceries and making that meal yourself. Chances are you’ll get more food (which can last you a few days) for less money! Make a meal plan so you can create a grocery list. Don’t forget to account for leftovers and snacks!

The same goes for making your coffee at home. Say you spend a generous $5 a day when you purchase a coffee from your favourite coffee shop. That’s $25 a week, $100 a month and, well, you do the math. Coffee purchases add up so making your own is a simple way you can reduce your expenses and put that money towards your savings.

7. Shop at the dollar store

Yes, you read that right. The dollar store actually has more than you think. Need miscellaneous kitchen gadgets like tongs or a spatula? The dollar stores’ got it. How about supplies like trash bags or canned soup? You guessed it—you can find it at the dollar store. Next time you’re near one, pop in and see what you can find. You’d be surprised at what you can get at a much lower price than your typical grocery store.

8. Unplug electronics when you aren’t using them

Laptop chargers, desk lamps, fairy lights, speakers—if you have electronics you don’t use all the time, keep them unplugged. Your energy bill (and the planet) will thank you.

9. Change your television service

These days it seems more and more people are opting out of their cable services (and for good reason). If you’re into TV shows and movies, try Netflix, Crave, Hulu or Disney Plus. There’s a subscription service out there for everyone, and they typically come in at a much lower cost.

10. Automate your payments

If you’re super busy, it can be easy to forget to pay your bills. When you automate your payments (AKA schedule them ahead of time) you won’t have to think about paying off your Visa or your phone. It’s an easy way for you to make your payments on time and boost your credit score.

11. Pay your bills on time

If you get into the habit of paying your bills on time, you’ll be glad you did. When you develop good budgeting habits and save accordingly, you’ll always have the funds you need to pay your bills when they’re due.

We’re going to break down Manitoba tax brackets based on yearly earnings so you’ll be more prepared and informed by the time you file your tax return this year.

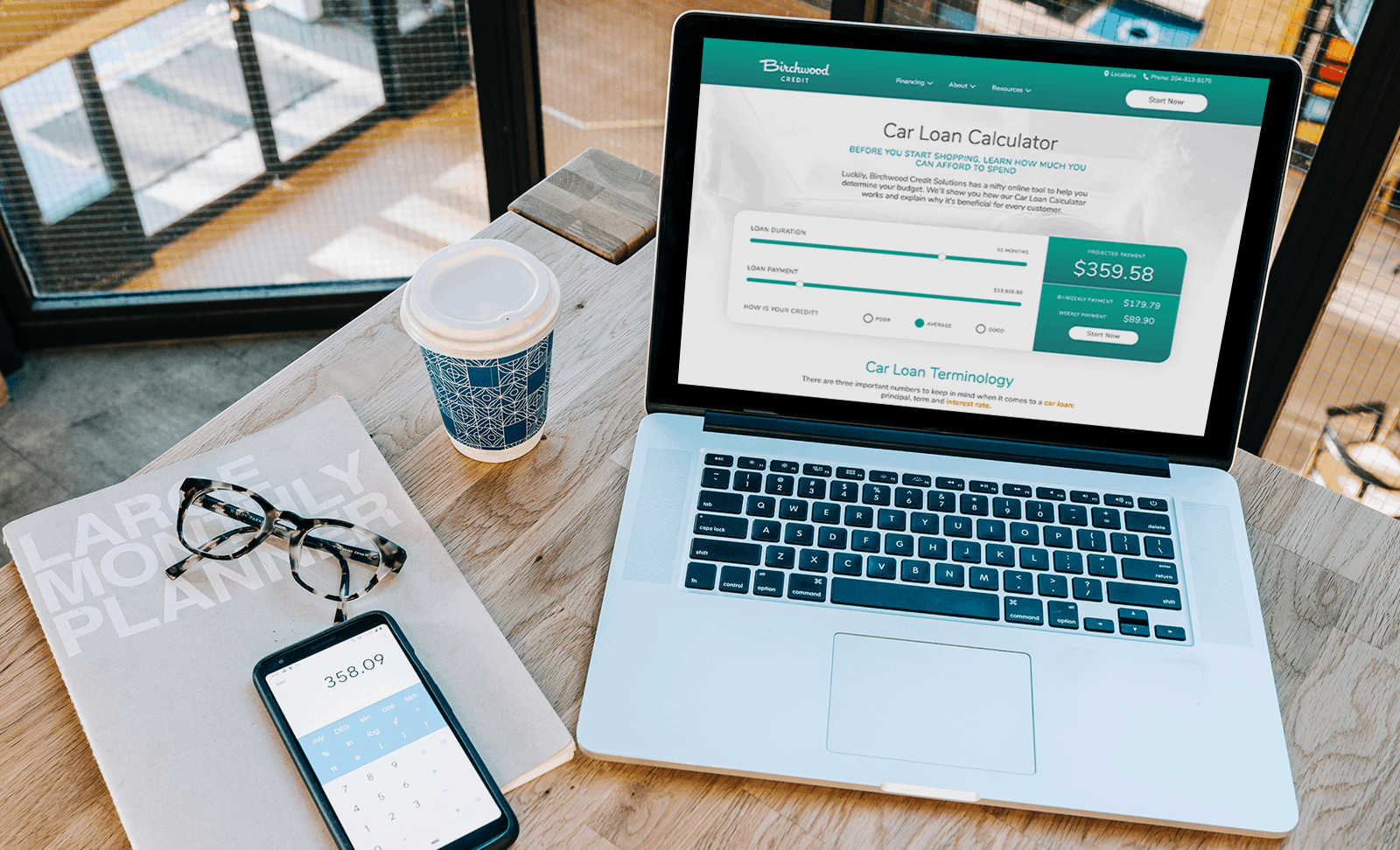

Now that you’ve got some great tips on ways to save money on a tight budget, you can start thinking about things you want to save for. Maybe it’s a new car? If you want to incorporate saving for a car into your budget, try our online Car Loan Calculator. You can adjust your loan duration and loan payment so you can estimate how much you’d need to budget for monthly payments.

If you have any questions on how to get started, contact our credit experts and they’d be happy to help you out.