Manitoba Tax Brackets 2020: Learn the Benefits and Credits

2020 was an unpredictable year and many Manitobans had to deal with job loss and pay cuts. As we go into tax season, it’s important to understand the tax bracket you fall under based on the past year as it’ll help you budget and estimate how much you owe.

We’re going to break down Manitoba tax brackets based on yearly earnings so you’ll be more prepared and informed by the time you file your tax return this year.

What is a tax bracket?

Tax brackets segment the population based on income. Since Canada has a progressive tax system, the government calculates the percentage of taxes you owe based on your annual income. In other words, the less you make, the less taxes you pay and the more you make, the more taxes you pay. Your taxable income is your gross income from all sources, after any applicable deductions.

Canadians have to pay both federal and provincial taxes. Once you know your taxable income, you’ll calculate your federal income tax then provincial and add them together. This is your marginal tax rate, or the total money you owe on your income tax. Tax brackets are created to help you calculate those numbers and keep taxes fair among Canadians.

Federal tax brackets in Canada

In Canadian federal tax brackets, the tax rates only apply to the earnings that fall within each segment. Let’s break down the 2020 federal tax brackets and rates.

| Annual Taxable Income

(Tax Bracket) |

Tax Rate | What You Pay |

| Up to $48,535 | 15% | 15% on the first $48,535 of your taxable income |

| $48,535 to $97,069 | 20.5% | 20.5% on the next $48,534 of your taxable income |

| $97,069 to $150,473 | 26% | 26% on the next $53,404 of your taxable income |

| $150,473 to $214,368 | 29% | 29% on the next $63,895 of your taxable income |

| Over $214,368 | 33% | 33% on anything over $214,368 of your taxable income |

*NOTE: The Canada Revenue Agency has yet to release 2021 federal tax information.

How to identify your federal tax bracket

Seeing these numbers is one thing but you have to be able to interpret your federal tax bracket.

Say you make $35,000 gross per year. This means you’d be in the lowest federal tax bracket for 2020 and would owe 15% of your wages – around $5,250.

If you make $100,000 annually, you’ll have to make some additional calculations. Based on your income, you’ll be taxed under three different brackets.

- You will be taxed 15% on the first $48,535 of your income.

- You will be taxed 20.5% on the next $48,534 of your income.

- You will be taxed 26% on the final $2,931 of your income.

Your income tax would be calculated as follows:

48,535 x 0.15 = $7,280.25 in tax

48,534 x 0.205 = $9,949.47 in tax

2,391 x 0.26 = $621.66 in tax

If you add up the tax rate for each tax bracket you fall under, you would owe ~$17,851.38 in federal taxes if you make an annual salary of $100,000.

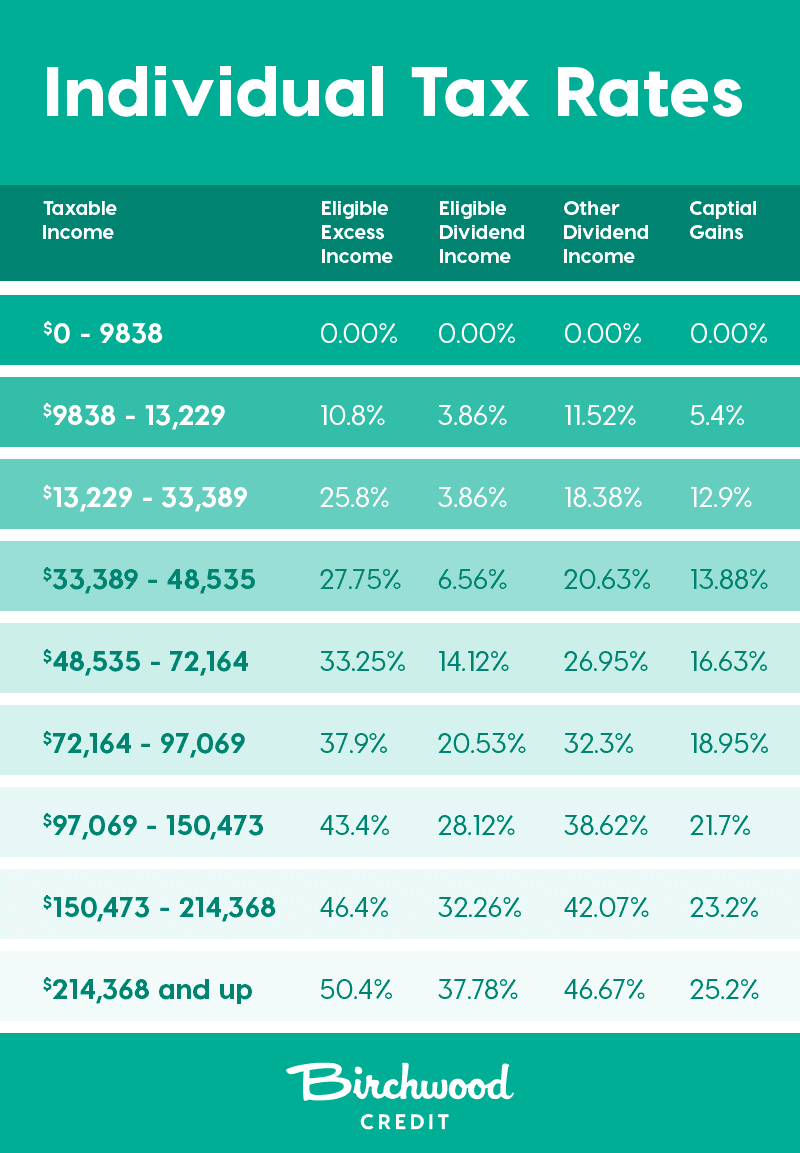

Manitoba tax brackets

Provincial tax brackets work similarly to federal tax brackets. Here’s a breakdown of Manitoba’s 2020 tax brackets.

| Annual Taxable Income

(Tax Bracket) |

Tax Rate | What You Pay |

| Up to $33,723 | 10.8% | 10.8% on the first $33,723 of your taxable income |

| $33,723 to $72,885 | 12.75% | 12.75% on the next $39,162 of your taxable income |

| Over $72,885 | 17.4% | 17.4% on anything over $72,885 of your taxable income |

Tax calculations work the same for provincial and federal brackets. Once you calculate your federal income tax and provincial income tax, you’ll add them together to calculate your marginal tax rate (the total amount you owe).

*NOTE: The Canada Revenue Agency has yet to release 2021 provincial tax information.

Tax deductions and how they work

There are many personal tax credits that can be applied to your income tax calculations. However instead of directly reducing the amount of taxes you need to pay, tax deductions/credits reduce your gross income, which in turn could move you into a lower tax bracket and reduce the amount of taxes you owe.

There are many possible deductions so it’s important to research which ones apply to you. Here’s a list of common tax deductions:

- Pension Adjustment

- Registered Retirement Savings Plan (RRSP)

- Childcare

- Charitable donations

- Union dues

- Post-secondary education

- Caregiver rebate

- Disability

Calculating your income tax

Many people hire agencies and other organizations to do their taxes for them. However, if you’re interested in doing it yourself, there are plenty of tools and websites designed to make it easy. You can try TurboTax for as low as $0 and SimpleTax is completely free. You can also use the Government of Canada’s NETFILE service.

If you simply want to estimate your federal and provincial taxes as well as your return, you can try the TurboTax income tax calculator or neuvoo’s income tax calculator based on salary.

How to maximize your tax return

If you’ve overpaid what’s owed on your taxes throughout the year, you’ll get a tax return. If you’re wondering how to maximize your tax return this year, we’ve put together six things you can do to make the most of your refund. You can read our full blog for more information but we’ll summarize the tips here.

- File your return on time. This one’s easy! There are penalties for not filing your taxes on time so it’s an easy cost to avoid if you get them in before the deadline.

- Claim family benefits. The Canada Child Benefit (CCB) applies to anyone with children under 18 years of age who is their primary caregiver. It’s a non-taxable benefit paid monthly based on your family’s adjusted net income.

- Claim student deductions. If you’re a post-secondary student or recent graduate, you can claim your tuition and other education-related costs.

- Moving expenses. If you moved to attend university or transfered to a new job, you can claim moving expenses like transportation, storage and temporary living expenses.

- Claim your GST/HST credit. All you have to do to claim this credit is file your taxes!

- Utilize your savings accounts. Contributions to your RRSP are eligible for a tax refund so don’t forget to account for them.

Filing your income tax doesn’t have to be stressful. We hope this tax bracket breakdown has made it simpler and easier to understand as we approach tax season.

Our offices are open though if you’d prefer to shop from the comfort of your home, you can with our Buy From Home program. Your entire buying experience will be 100% contactless from the loan approval and vehicle shopping to the test drive and delivery. You’ll even get a $1000 rebate and other added benefits. Visit our Buy From Home page for details.