Checklist: Budgeting for Your Next Vehicle Purchase

Buying a new car is exciting. There’s nothing quite like leaving the lot with your hands on the wheel and thinking, this is actually mine!

Although you’ll want to go out and grab that new ride ASAP, it’s worth taking the time to understand the costs ahead and how to prepare for them. Understanding your budget will make the buying process way easier because you’ll be one step closer to finding the perfect ride for you.

COSTS OF BUYING AND OWNING A VEHICLE

The costs of a car can vary greatly depending on credit score, make/model and where you’re buying it from. Here are 6 basic costs to be aware of:

- Sticker price

- Down payment

- Taxes

- Insurance payments

- Gas

- Maintenance

For some, there are additional operating costs too. Do you plan on paying for a monthly parking spot? If you live in the country, you might face different maintenance costs than those in the city. Will you take out a car loan? Consider the costs of interest and monthly payments as well.

WAYS TO BUDGET FOR A NEW VEHICLE

DEFINE YOUR BUDGET

Do you know how much you’re ready to spend? Remember that monthly costs are different from the cost it’ll take to buy the vehicle in the first place.

If you want to reduce your monthly payment, you can make a larger down payment as this reduces the interest on your car loan. Other factors on your car loan costs include the loan duration and credit score.

To generate some estimates on the costs of your car loan, check out our car loan calculator! Keep in mind, these estimates are made to help you get an idea for budgeting. In reality, the costs could be cheaper than we generate even if you have a poor credit score.

If you can determine what a comfortable monthly payment looks like to you, you’ll be able to narrow down vehicles to ones that fit your budget.

ESTIMATE MAINTENANCE COSTS

Routine maintenance will extend your vehicle’s lifespan and prevent depreciation. But how much does maintenance cost? It’ll depend on if you can perform these tasks yourself or through a shop. Let’s get an idea!

- Oil changes should be performed around every 3 months or 4000 kilometres. Most oil changes at a shop will cost around $60 to $140.

- You should also swap your wiper blades every 6 months. There’s a good chance you’ll be able to do this on your own, saving you some money. Wiper blades cost around $20 each.

- If you swap between winter and summer tires, you’ll make the swap twice per year. Each time will cost about $50 to $75 if you use a shop. If you have to buy a new set of tires, you might be looking at around $600.

- At least once per year, visit a shop for a full car tune-up. The standard cost for a tune-up can range from $50 to $200, so be sure to compare prices and reviews for different shops. Keep in mind, you never know what expensive fix they may find, so be ready to pay an extra couple hundred dollars.

All in all, it is possible to budget your yearly maintenance within $500 per year. Still, we’d recommend keeping some savings ready in case there’s a larger fix hiding around the corner. It’s better to be prepared!

RESEARCH VEHICLES

Consider these questions when looking at vehicles:

- Does this ride meet the needs of my life?

- Are there cheaper vehicles that could also meet my needs?

- Is this vehicle available elsewhere for less?

Then, consider who you’re buying from. Are they trustworthy? Check out their Google reviews. If you’re looking to buy from an individual off of Facebook Marketplace or another private seller, be extra diligent. We encourage you to check the vehicle’s paperwork to see if the vehicle is a rebuilt title.

Rebuilt titles are vehicles that were previously written off, then rebuilt to be road legal again. Due to their cheap prices, they seem too good to be true. Because they were totalled, there can be all kinds of unforeseen issues with the car down the line, so be careful.

Remember: a used car is fine but watch out for rebuilt titles!

Wondering where to start? Check out our inventory!

TIP: Be careful getting quotes from multiple dealerships. If dealerships are using your social security number to check your credit score, this can actually hurt your score, making the process more expensive in the end. It’s best to keep your hard credit checks to a minimum.

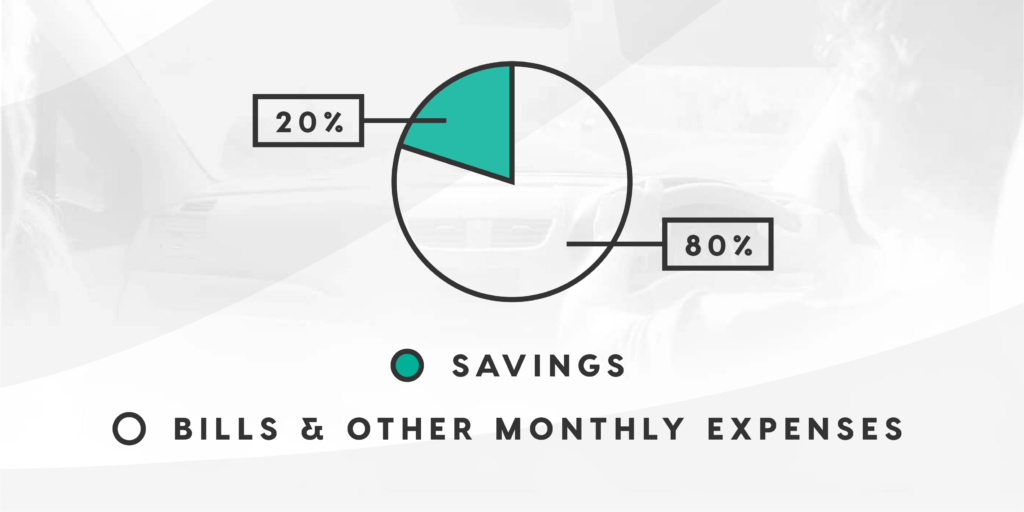

SAVE 10-20% OF YOUR PAYCHEQUE

A good rule of thumb is to set aside 10–20% of your income for the new car. This way you won’t have to dip into your savings, which are better off saved for emergencies, vacations, retirement, or any number of other expenses.

Alternatively, perhaps you can find ways to make 10–20% more. Could you get a raise? Sell some things you no longer need? Start a side hustle? You’ve got this!

LIMIT DEBT TO 36%

When it comes to budgeting, it’s a good idea to limit how much of your income is spent paying off debt. According to Business Insider, you can’t go wrong aiming to keep that spending beneath 36%! This is because spending more than 36% can make it harder to qualify for loans from banks.

Do you have room in your budget for a monthly car loan? If you think you’ll be cutting it close, let us know — we’ll work with you to find a plan that’s sustainable.

Mind you, some debts can help you save money more than others. If you haven’t already, look into getting a cash-back credit card while you save up. It might not seem like much, but the extra money saved can really add up! Plus, your credit score might improve, reducing your spending on interest and so on.

REDUCE MONTHLY EXPENSES

With new monthly expenses for your vehicle (including unexpected maintenance), it might be good to evaluate your current monthly spending. How many streaming services do you pay for you? Are you using Spotify or Apple Music? Perhaps you can cut down to just one TV streaming service and try free alternatives such as Tubi or Plooto. If you’re using Spotify, can you split it with a friend or switch to the free version?

If you enjoy a magazine subscription, video games, movies, or books, get a library card. The City of Winnipeg library card grants you access to all of these resources and is completely free. Many movies and magazines can even be accessed on their website. If there’s a physical copy at a different location than the one you use, they’ll ship it to your preferred library for free.

There are all kinds of other ways you can cut down costs, such as switching to no-name brands when grocery shopping or eating out less.

WHERE TO BUY A VEHICLE IN WINNIPEG

Ready to buy? Congrats! We encourage you to swing by one of our locations—whichever is closest to you—and take a look at our inventory. Our credit experts will happily answer any questions you have!