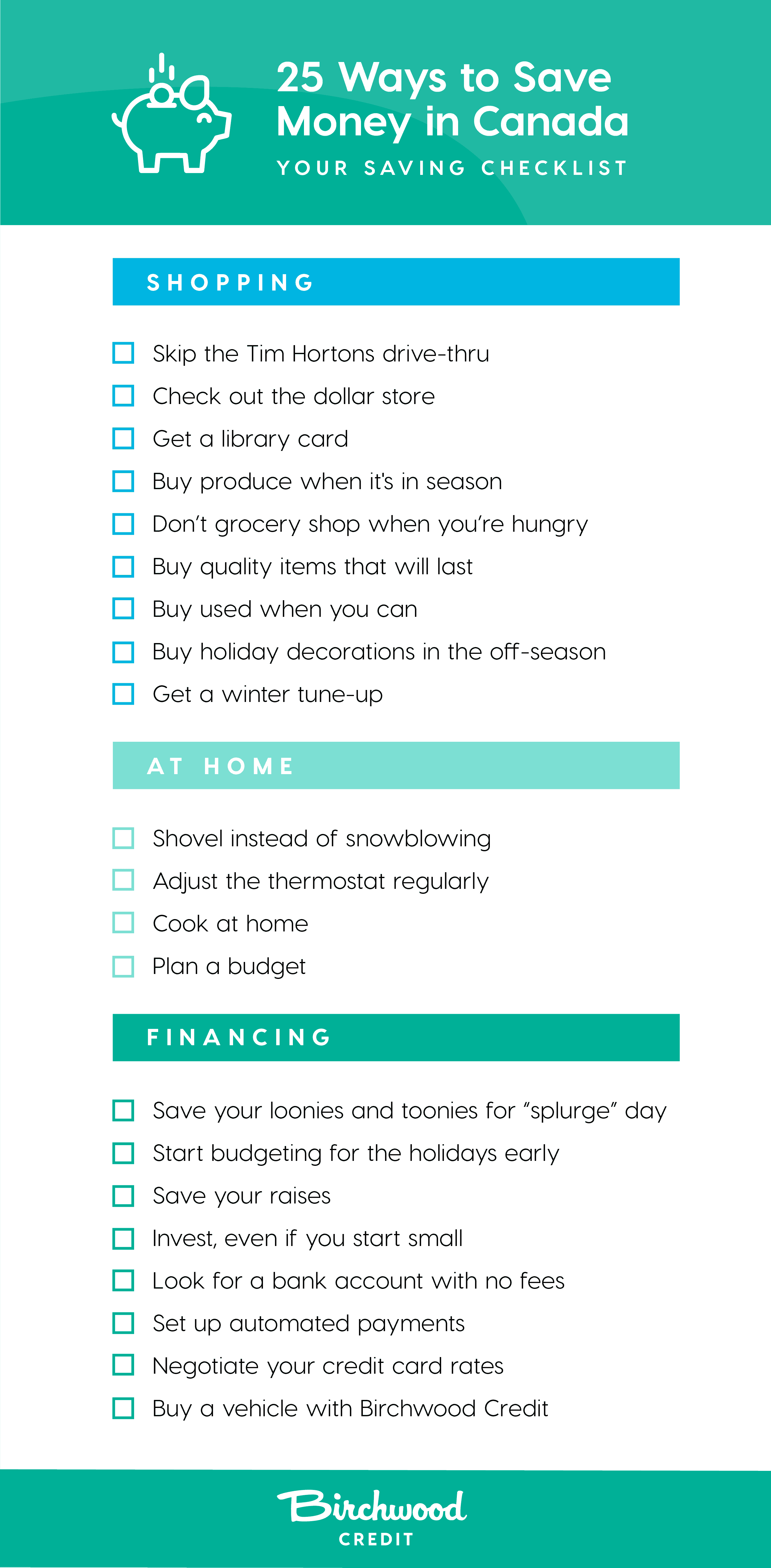

Our Top 25 Ways to Save Money in Canada

No matter where you are in your financial journey, there’s never a bad time to focus on saving money. While it may seem challenging to put money away given the state of the world, we hope you take comfort in knowing there are small changes that can still help you save money in the long run.

We’ll give you 25 tips on how to save money in Canada in a variety of saving categories. Choose strategies you think will work best for you and will hopefully get you closer to achieving your financial goals.

In no particular order, here are our tips.

1. Skip the Tim Hortons drive-thru

Nothing says Canada like a classic double-double from everyone’s favourite coffee house. But statistically speaking, if you’re opting for the drive-thru five days a week, you’re spending at least $500 on coffees every year! Brewing your own joe in the morning could easily cut down your costs. Invest in a fun travel mug, brew your coffee at home and sip it throughout your day.

2. Negotiate your credit card rates

Is your interest rate 18% or higher? If yes, many credit card companies will be willing to drop this rate for you, especially if you’re willing to take your money elsewhere. Most Canadian credit card companies will also be willing to negotiate no annual fee — another great way to save a few pennies each year. Look for cards that offer lower rates for the first six months.

3. Get a winter tune-up

It may seem counterintuitive to suggest spending money to save money, but ensuring your vehicle is running at peak efficiency during the coldest winter months will save you gas money. To get the best fuel mileage, ask your mechanic to check your wheel alignment, change your oil and look at your battery at least once a winter.

4. Save your loonies and toonies for “splurge” days

Small change adds up! Take the “coin jar” approach to saving. Each time you have spare change, throw it in a glass jar. Once the jar’s full, roll it up and deposit it into the bank. You may be surprised at just how much you can put away.

5. Shovel instead of snowblowing

Manitoban winters can be brutal and there probably aren’t many people who want to spend time in below-freezing temperatures if they don’t have to. But picking up the shovel can save you hundreds of dollars on gas each winter. If you decide to invest in a snowblower, see if you can clean up your neighbour’s driveway for a small charge to offset the cost.

6. Set up automated payments

If you have the option, set up automated repayments when it’s available to you. Whether it be on credit cards, phone bills or streaming services, it will ensure you’re paying bills on time and also increase your credit score. Plus you won’t have to worry about missing a payment.

7. Shop seasonally

You don’t have to be a farmer to recognize what type of foods are in season where you live. Berries in the summer, apples in the fall and canned legumes in the winter are usually cheaper during their growing seasons. Plus, it feels festive to shop with the weather!

During the winter, shop for deals on canned goods. In the summer, visit farmers markets and find discount produce that can be made into salsas, jams and other preserves. If you shop strategically, you can have tasty and nutritious food all year round.

8. Adjust the thermostat regularly

Change your thermostat setting anytime you leave your home for eight hours or more. There’s no need to heat or cool your home when you’re not in it and you’ll save money. When you are home, pay attention to the temperature and feel free to adjust your thermostat as needed. If you can avoid leaving it at one temperature for months on end, you’ll end up saving money as the temperature fluctuates.

9. Cook at home

As tempting as takeout is, you’ll save a lot more if you cook at home and pack your own lunch for work. For date night, cook a meal and have an indoor picnic! You’ll have just as much fun and save money.

10. Plan a budget

Create a spreadsheet with your spending categories and allocate a certain amount to spend in each category per month. Be realistic with what you can afford but also leave a little buffer room to treat yourself if you can. And don’t forget to put some money into savings!

11. Do simple car maintenance at home

Surely we should all leave some car maintenance to the professionals, but why not save a few bucks and do the simple things yourself? A quick Google search will take you to oil change videos and tips for other minor fixes. Instead of heading to the gas station car wash, you could also opt to do a DIY cleaning at home in the driveway.

12. Work out at home

If you have free weights, resistance bands and a mat, you’re set for an at-home workout. Even if you don’t have these items, cans of soup or sauce work just fine and you can use your own body weight for many exercises. You’ll avoid the pricey fees of a gym and still get a great workout.

13. Check out the dollar store

The dollar store is a great place to pick up everyday staples. You can usually find Ziploc bags, dish soap, kitchen utensils and even seasonal decor at your local dollar shop.

14. Get a library card

Books are pricey and if you’re an avid reader, it’ll start to add up. Opt for a library card – you pay a yearly fee and you can read as much as you want. If you’re up for something different, grab your phone and try a free audiobook from audible. If you have an eReader, Kindle offers many eBooks for under $5, including free books. There’s plenty to choose from and all you need is the internet.

15. Get creative and DIY

If you have a small project to do around the house, why not do it yourself? Whether it’s fixing a ripped shirt, creating a home decor piece or staining your deck, you’ll save a lot of dough if you can DIY.

16. Cut out cable

Cable is expensive and there are plenty of streaming services that will give you plenty of TV and movie options for a fraction of the cost. Netflix and Crave cost as low as $9.99 a month, hulu costs $11.99 a month and for the kids (of all ages), Disney+ costs as low as $8.99 a month. You’ll save money not paying for cable without sacrificing your entertainment options.

17. Don’t grocery shop when you’re hungry

Always eat before heading to the grocery store. If you shop on an empty stomach, you’ll probably be tempted to buy more than you actually need (or end up buying more treats). It’s a good idea to prepare a list beforehand so you have a clear idea of your meals for the week ahead.

18. Buy quality items

It’s important to find a balance between quality and cost but you’ll be happier if you buy an item that will last. If you always purchase cheap items, you’ll have to replace them more often and you’ll end up spending more on the same things. Instead, invest in quality pieces and you’ll head to the store far less often.

19. Buy used when you can

Another way to save on clothes, home decor, kitchen gear and more, is to head to the thrift shop. It’s better for the environment and your wallet and you’ll have a better chance at finding something completely unique.

20. Buy holiday decorations in the off-season

Holiday decorations usually go on sale the day after. If you need some new decor for next year, consider shopping after the holiday and save those discounted items for the following year.

21. Start budgeting for the holidays now

The holidays can creep up quickly, so if you can, start budgeting and saving for your holiday shopping early. If you have money allocated for certain holidays, you’ll feel better having a plan as you’ll know exactly how much money you have to work with.

22. Save your raises

You got a raise at work – congratulations! Instead of spending it, think about saving or investing that money. It’s a great opportunity to put more away and grow your savings.

23. Invest, even if you start small

Building good investing habits can really pay off in the long run. Investing may seem daunting if you’re new to it, but you’re in complete control and can invest as much or as little as you want. Start small – try investing $50 a paycheck and see how you feel. Chances are, if you invest a small sum every two weeks when your paycheck comes in, you won’t even miss the money.

24. Look for a bank account with no fees

If you find one, a zero-fee bank account is an easy way to cut down on small expenditures. Even if you save $100 a year, it can add up over time and you could put that money into investments or savings instead.

25. Buy a vehicle with Birchwood Credit

If you need a new vehicle and are looking for an affordable payment plan, our credit experts can help you get approved. We lend our own money which means we can give better rates, faster approvals and more affordable payment terms.

You can fill out an online Car Loan Application and our credit experts will help you find a payment plan that meets your budget and lifestyle. You can also get a complimentary, secure credit report so you can know where your credit stands. Start your Secure Credit Check and take your first step to financial independence.

There are many ways you can cut down your expenses and start saving more effectively. If you’re looking for even more tips, you can check out this article from The Simple Dollar.

Our team wanted to do something to help our local community this holiday season. We proudly donated over 200 pairs of mittens to Main Street Project, a local organization that provides shelter, food and support to individuals in need. Read more about it here.

We researched the top 10 most common credit score myths and have explained them below so you can start to improve your credit score today. We have even added a couple of ways that Birchwood Credit works to debunk these myths, making it even easier to become more knowledgeable about your credit.

If you need a new vehicle and are looking for an affordable payment plan, our credit experts are ready to help you, even if you have bad credit. You can fill out an online Car Loan Application and our credit experts will help you find a payment plan that meets your budget and lifestyle.