What Are Interest Rates and How Do They Work?

Interest rates—you’ve probably heard of them. But what exactly are they? How are they calculated? Don’t worry — after reading this post, you’ll feel confident discussing them with everyone from friends to bankers.

WHAT ARE INTEREST RATES?

When it comes to credit, interest is the cost of borrowing money. In some cases, this figure is high and in other cases, very affordable.

All lines of credit can involve interest rates, such as mortgage loans, car loans, credit cards and so on. Keep in mind that interest can also be a positive thing. If you contribute to a savings account at a bank, you might have interest that builds and actually makes you money.

In the end, interest affects either how much you own, or how much you owe.

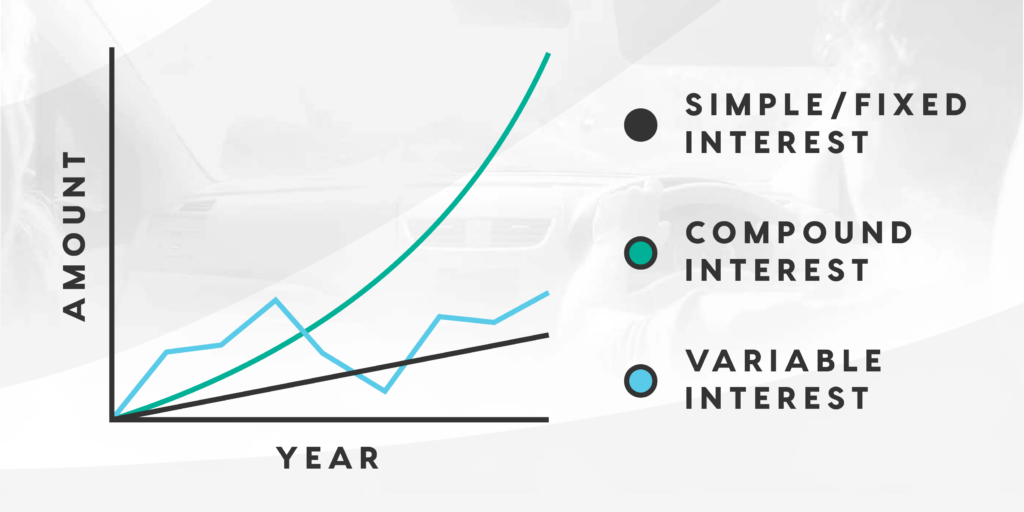

There are also different types of interest, including:

- FIXED: Fixed interest (or simple interest) refers to when an interest rate is determined for the full duration of the loan. This makes it easy to estimate payments and is most commonly used for car loans.

- VARIABLE: Also called floating interest, these rates fluctuate periodically. These loans, often used in mortgages, can change depending on market benchmarks, which we’ll talk more about later.

- COMPOUND INTEREST: Compound interest is interest that is calculated based on previous interest calculations within the same loan. In other words, the interest accumulates. These interest rates are used for open-ended lines of credit, like credit cards. The calculation of how much you owe for this interest is called the Annual Percentage Rate, or APR for short!

HOW ARE INTEREST RATES CALCULATED?

As mentioned above, variable loans are often dependent on market benchmarks.

These benchmarks are linked to the Bank of Canada’s policy interest rates (also referred to as the overnight rate), which determines the cost banks must pay when borrowing money. These rates are determined eight times per year by the Bank of Canada’s Governing Council. Banks borrow money from the Bank of Canada to meet federally-governed reserve requirements.

Banks can control how much interest they charge on loans they issue (like mortgages), but they don’t have any say over the overnight rate from the Bank of Canada. How much banks charge correlates with how much they’re being charged.

The Bank of Canada uses this cost to impact the Canadian economy. For instance, if the federal government wants to increase spending and spur the economy, it will drop the overnight rate, as this will spur banks to reduce their interest fees and save Canadians money. If the government wants to slow spending, it’ll increase the overnight rate. This makes loans more expensive and influences the affected Canadians to reduce spending!

You can watch for changes to the overnight rate on the Bank of Canada website!

On a smaller scale, interest rates are determined by other factors, such as credit.

HOW MUCH DOES CREDIT AFFECT INTEREST RATES?

As a borrower, you’re asking lenders to trust you. They have to trust that you’ll pay them back in full and on time.

If they trust you a lot, they won’t charge you high-interest rates because they believe their investment in you is safe. However, if they don’t trust you, they’ll protect their investment by charging high interest.

But how do they decide if they can trust you?

With traditional lenders, the answer is credit. Credit scores are calculated based on a variety of factors, including your history of paying back credit and how much credit you use. If you use a lot of credit, and miss payments, this reduces your score.

If you have excellent credit (over 750), you could be offered a low mortgage interest rate of 2.5%, meanwhile, someone with a score of under 600 might receive a rate of 5.5%. Of course, these percentages could differ greatly as the overnight rate changes, but the range will likely remain the same. As a rule of thumb, the better your credit, the lower your interest rate. Check out our Car Loan Calculator to see how credit and other factors can affect a car loan cost.

Credit scores are calculated by credit bureaus. In Canada, these are TransUnion and Equifax. You can perform a soft inquiry with these institutions once per year for free, and it won’t hurt your credit. It’s a good idea to take advantage of this service before applying for loans as you’ll have a better grasp of the interest rates you qualify for.

If your credit score isn’t as high as you’d like, that’s alright. With a little help, you can get that score to soar. See some of our tips for building credit!

THE BIRCHWOOD CREDIT APPROACH

While we understand why traditional lenders put so much weight on credit, we believe there’s a better road forward. Sure, looking at a score and knowing how much to charge must be really convenient for banks, but it’s not very humane. You can have a low credit score and still be a trustworthy borrower.

Credit scores can dip for so many reasons. Maybe you’ve been using too much of your credit card for spending because you believed this would help build your score. There are all kinds of myths like this out there. Or maybe life took a detour and hurt your score, but you’re back on track now. In any instance, you are a real person, not just a three-digit number.

We consider your entire financial situation when calculating interest on car loans. In fact, we offer Bad Credit Car Loans that are affordable with the intention of helping your credit score. Our team will get to understand what’s feasible for you so you can find a ride that’s right for you at an affordable rate.

Ready to learn more about your score? Begin your Secure Credit Check today!