Unlock Easy Auto Financing

Does the thought of buying your next ride stress you out? The process of applying for an auto loan can be tricky. All the paperwork, options, jargon and more might daunt you. Plus, if you don’t get approved, that can be really discouraging. We know how you feel. But it doesn’t need to be this way.

We’ve made the steps of getting your new ride auto-financed easily. Take a look below to understand everything you need to know about buying your next ride!

Auto financing in a nutshell

When it comes to auto financing, there are a few terms you should be aware of:

• Principal: The principal is the total amount of money you’ll be borrowing for the loan.

• Interest: Interest is the cost of borrowing money. For auto loans, most interest is fixed, meaning that the rate won’t fluctuate. This makes it easy to predict future payments.

• Term: This is the duration of the loan. Keep in mind, the term can change based on how often your plan requires you to pay and how much you’re paying. We adjust these according to the budget that suits your financial situation.

• Down Payment: The down payment is the amount of you pay toward a loan at the beginning of the loan. It reduces your principal and interest. We recommend a down payment of 10–20% of the vehicle price.

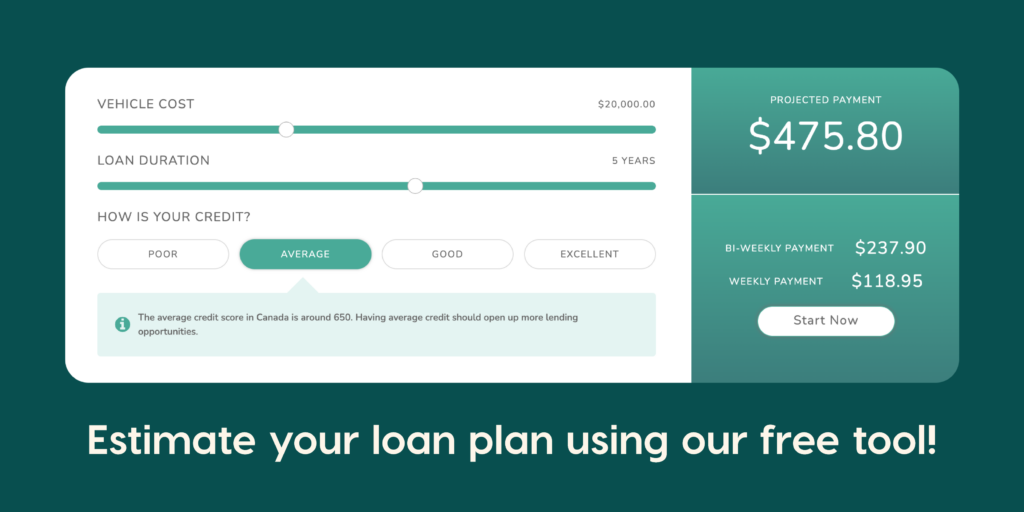

Estimate your loans with our free Car Loan Calculator!

HOW DOES YOUR CREDIT SCORE IMPACT YOUR INTEREST?

Traditional lenders use your credit score to determine if you qualify for a loan and the cost of interest. If you have a great score (725+), they interpret this to mean that you’re a trustworthy borrower, so they offer cheaper interest rates. However, we take a different approach.

We believe it makes more sense to review your entire financial situation and to cater our interest rates according to what works for you. After all, there are so many reasons a credit score can take a hit, and they’re not all your fault!

MYTHS ABOUT AUTO LOANS

There are all kinds of myths out there, so watch out! Here are a few to keep an eye out for:

• “You have to pick a vehicle before applying for financing”: Not true! Getting pre-approved can help you establish your budget ahead of time, making it easier to select a vehicle within your budget.

• “You have to make a large down payment”: Actually, there are quite a few dealerships in Winnipeg that don’t require large down payments—us included. It might not be feasible for you to spend a lot on a down payment right now, but you still deserve the opportunity to have your own vehicle.

• “It pays to shop around for the best rate”: The truth is you should be very careful shopping around. If dealerships are requesting information such as your SIN number, they may be performing inquiries on your credit score. Too many of these inquiries can hurt your score!

If you don’t have the greatest credit score, you can still get pre-approved for an affordable loan with us! Pre-approval makes shopping for a ride much easier. See why below.

From pre-approval to a new ride

By submitting some basic information such as your name, email and occupation, we can estimate the loans you’d qualify for. This makes the buying process much easier because you’ll have a starting point when looking for vehicles. It’s a lot easier than taking a look at every vehicle, finding one you like, then realizing it’s beyond your budget.

You can start the process here!

Once you have your pre-approved loan, you can browse our inventory either online or at any of our dealerships, where our credit experts can lend a hand. We offer a wide range of SUVs, trucks, cars and vans so that you can find the right ride for your lifestyle. Let’s face it, owning a vehicle in Manitoba is pretty much a necessity, so it’s only fair that you should have access to affordable options.

If you have any questions about the purchase journey, credit building, auto loans or more, get in touch with a member of our team. Our credit experts speak many languages and are here for you at every stage of the process.

Unlock Auto Loans on Easy Mode

If you purchase a new ride anytime from April 10 to June 30, you’ll be entered to win one of three $1,000 giveaways! You’ll also unlock one of the following instant prizes:

○ 5 x $100 for Luxe BBQ

○ 5 x $100 in outdoor goods gift cards

○ 30 x $100 gas gift cards

○ 10 x $100 cash

We know these prizes will make your auto buying experience just that much easier. Good luck!