Understanding your Credit Score and Why it Matters

Your credit score is the key to better borrowing power and a healthier financial outlook. That’s why at Birchwood Credit, we do everything we can to help you understand your credit – what it is, how it’s determined and why it matters so much.

We also want to guide you through some simple steps that anyone can take to improve their credit score. When it comes to credit, we’ve got your back! Keep reading to learn more.

WHAT IS A CREDIT SCORE?

Your credit score is an important piece of your financial footprint. It allows you to buy a new vehicle, get approved for a mortgage and make purchases on a credit card. If your credit score is high, you’ll have access to more financial opportunities with better rates.

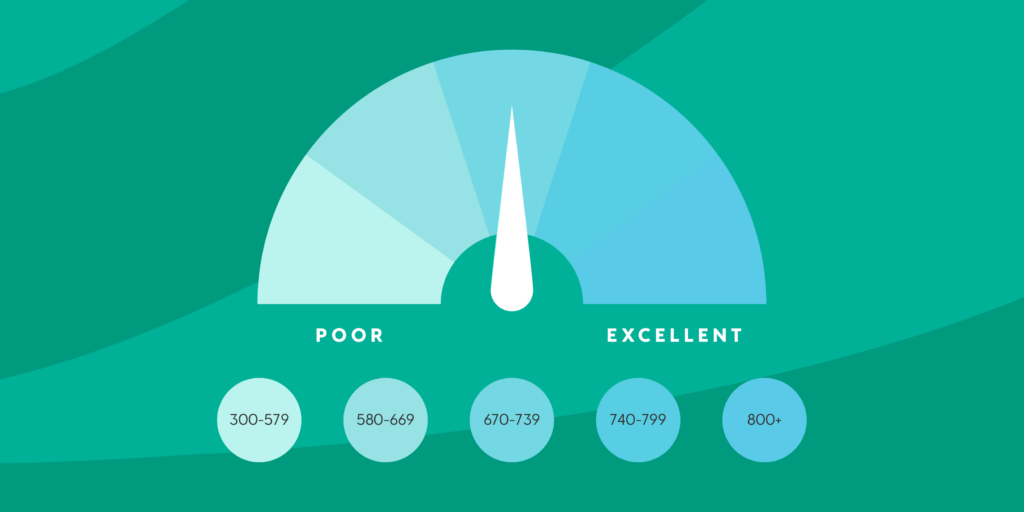

Here in Canada, credit scores range from 300 to 900, with 900 being a perfect score. If you have a score between 780 and 900, your score is considered excellent.

If your score is between 700 and 780, it’s still considered a strong score and you will most likely be approved for financing at good rates.

When you start hitting 625 and below, your score is considered on the low side and you will probably start finding it difficult to qualify for any borrowing or financing options.

Get a complimentary and secure credit report so you know where your credit stands with our Secure Credit Check.

WHAT IS A CREDIT REPORT?

Your credit report is a summary of information on file with credit bureaus, which are companies that collect data around how you handle credit. The main credit bureaus in Canada are Equifax and TransUnion. Once a year, you can request a free copy of your credit report by mail, though if you want instant results online, there will be a charge.

There are also several apps available for you to check your credit free of charge or you can use our free and easy Secure Credit Check.

Your credit report contains specific information about your financial background including:

• Credit you use (credit cards, retail or store cards, lines of credit and loans)

• Payment history and missed payments

• Accounts closed

• Bankruptcy or a court decision that relates to credit

• Debts sent to collection agencies

• Inquiries from lenders or anyone who has requested your credit report

• Registered items such as a car lien

• Personal information available in public records

HOW IS A CREDIT SCORE DETERMINED?

Your credit score is calculated using these main factors:

Payment History: Simply put, if you pay your bills on time, your credit score will increase over time. If you miss payments, your credit score will decrease. How you handle (or don’t handle) payments will impact your score.

Amount of Debt Owed: The more debt you owe, the lower your credit score will likely be. If you miss payments, you aren’t proving to the lender that you will meet the loan requirements and your score will drop. If you can, keep your balance under half the available credit you have and avoid running your balance up to the limit.

Length of Credit History: The longer you’ve had open credit, the better opportunity you’ve had to build good credit. In other words, the longer you’ve been paying back credit on time, the higher your credit score should be. On the flip side, the less credit you’ve had over a short period of time, the less your score may be since you haven’t had a chance to use it and build your reputability.

Number of Credit Products: The more credit products you have, and the more variety, the better your score. This gives you the opportunity to show lenders you can manage many different products responsibly (like a credit card, mortgage and car payments).

Public Records: If you’ve claimed bankruptcy in the past or have had prior collection issues, these will be factored into your score.

Credit Inquiries: Your credit score takes a small and temporary hit each time a lender accesses your file. However, your score will drop if you apply for a bunch of new credit in a short period of time. This does not apply to pre-approvals or personal credit report requests.

WHY DOES CREDIT HISTORY MATTER SO MUCH?

Potential lenders prefer to see an established history of managing credit, as it proves to them that you will be responsible with new credit. They will be looking at things such as how long it’s been since you first obtained credit, how long you’ve had each account for and how actively you’re using your current credit.

Here are other reasons why credit history matters:

• Better credit history means better interest rates when borrowing money

• A lack of credit history (or bad credit) can make it harder to borrow new credit

• Some workplaces and rentals will base application approval on your credit

Getting familiar with your own credit history is also great for catching signs of identity theft. By checking your report at least once a year, you can see if someone has tried to open credit cards or other loans in your name.

HOW CAN I IMPROVE MY CREDIT SCORE?

If you’ve been reading this blog and your heart has sunk because of bad credit – don’t fret! There are ways to improve your credit score. Here are a few things you can start doing today:

• Get familiar with your credit report and score

• Make payments on time

• Pay your card balances in full

• Don’t go over your credit limits

• Limit your number of applications/inquiriies

For more steps on how to improve your credit, check out this blog.

REBUILD YOUR CREDIT WITH US

We understand you may have less-than-perfect credit for reasons beyond your control. We also believe that people deserve to get a car loan, no matter what their financial history looks like. We have the experience and resources to help with all the following types of credit situations:

• Bad credit/no credit

• First-time car loan applicants

• Getting a car loan after bankruptcy

• Slow, late or missed payment history

• New to Canada

• Low income

• And more

Here at Birchwood Credit, we’ll not only help you drive away in a car you love, but we can give you guidance on how to rebuild your credit for a brighter financial future. Don’t let any credit concerns stop you from getting your next vehicle – apply for a loan today!