New Year, New Credit

At Birchwood Credit, we aim to be more than a car dealership. It’s one thing to help people find a new ride and quite another to improve the finances of those with less-than-perfect credit. Whether it’s with our blogs, financial managers, or low-interest payment plans—working with us means taking hold of your future. Read about the opportunities we’re creating for you!

CREDIT EXPERTS

Our team doesn’t set out to make sales. We want to truly help. You deserve a team of reliable and trustworthy credit experts. See our Meet The Team page to find members near you and get in touch! They love speaking with people about credit, vehicles and finance strategies.

Many of our Financial Services Managers speak multiple languages and have worked in auto finance for many years. It’s thanks to our 12 years of industry experience that we’ve helped over 20,000 Manitobans get into a new vehicle that meets their needs and budget.

By making a Secure Credit Check with Birchwood Credit, one of our credit experts will review your credit report with you to help you understand how your score got to where it is as well as what actions you can take to improve it. Secure Credit Checks are easy to complete. Simply fill out a small form, answer some questions from our team and we’ll review the results together! Understanding your credit is the first step to improving it.

IN-BUDGET INVENTORY

For those looking to purchase a vehicle, we can create an affordable auto loan that builds credit. Many traditional lenders, like banks, issue high-interest rates on all loans to those with poor credit. We believe a better, fairer approach is to look at your entire financial situation. You may have made some late payments or overused a credit card years ago, but now have better financial practices.

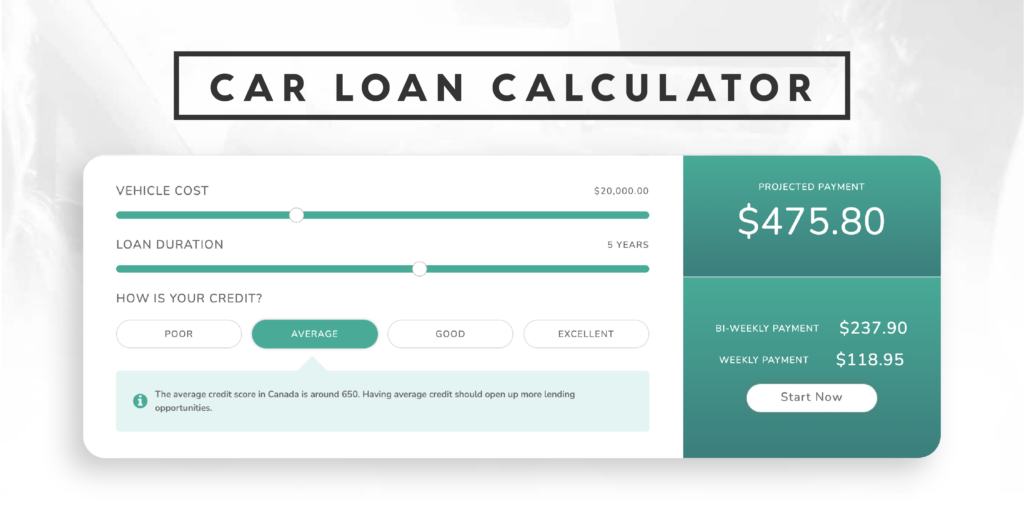

Everyone deserves the chance to drive a vehicle that meets their needs. Whether that means a truck for work and family fun or a car for your daily commute, we want to help. By speaking with one of our credit experts or using our Car Loan Calculator, you can estimate your auto loan budget and narrow down the inventory. We personalize the selection of inventory we show you so you won’t see something you like only to find out it doesn’t match your budget.

When using our Car Loan Calculator, you can adjust the vehicle cost and loan duration (the time it’ll take to pay off the loan) to estimate weekly, bi-weekly and monthly payment plans. Best of all, this tool is completely free to use and requires no personal info!

INSIGHTFUL BLOG CONTENT

With useful blog posts (like the one you’re reading!), you can uncover all kinds of useful tips and tricks. We have guides on:

How to Lease a Car in Manitoba

The Pros and Cons of Buying Used from Dealerships vs. Private Sellers

and so much more!

We encourage you to follow us on social media platforms to stay up to date on auto financing and local events. Subscribe to our newsletter to get an overview of every new blog post sent to your mailbox! Our first post was made in 2017—so there’s lots of knowledge waiting for you!

Ready to work with us? Begin your application today!