How to Manage Debt Problems Easily With These 9 Steps

If you feel like your debt is overwhelming, you’re not the only one. 73.2% of Canadians have some sort of debt.

Improving our lives, like getting an education, a car or a home usually requires going into a little bit of debt. No matter how small or big your debt amount is, you need to pay it off at some point. If you don’t know where to begin and are unsure of how to manage debt problems, we can help.

We’ve put together nine tips to help you pay down your debt and start rebuilding your finances. Since everyone’s situation is different, you’ll find what works best for you and your budget. Even if you start small, the sooner you start paying off your debt, the sooner you’ll rebuild your credit and take control of your finances.

9 tips to solve debt problems

1. Know how much you owe

Before you start tackling your debt, you need to know how much money you owe. If you don’t have access to this information, be sure to contact your creditors or a credit counsellor to assist you.

Gather and make a list of everything and everyone you owe. Make sure the list includes your creditors, total amounts due, monthly payments, interest rates, when each payment is due and your expected income.

Keeping all your debt information in one spot will help you stay on track, ensure you’re not missing anything and draw attention to what needs the most work. Make sure you refer back to and update it often after paying your bills. After analyzing your list, you can create a payment plan to tackle your debt.

2. Create a payment plan

Whether you note all your payments on a calendar or write them down in a checklist, make sure you create a payment plan to help you figure out which bills to pay and when.

A plan will help you stay on track with your payments and help you pay the most demanding areas of debt first. It’s a good idea to plan how you’re going to divide your income between your debt so there are no surprises or shortages when it’s time to pay.

3. Pay off your more expensive debts first

Instead of evenly distributing your debt payments, focus most of your attention on your largest debt. While this is a good strategy, this doesn’t mean you should neglect the rest of your debt. It’s still a good idea to make minimum payments – you’re simply focusing your attention on your largest debt. If your bills are relatively all the same size, start with the loan that has the highest interest rate.

This process will shrink your most expensive credit faster than it would if you were paying the same amount on all your debts. Once you pay the most expensive loan off, do the same with the next largest amount in line. You can carry this plan out until you pay all your debt off. You’ll feel good about seeing the numbers decrease and who knows, maybe it’ll motivate you to make larger payments when you can.

4. Pay more than the minimum

If you’re looking to pay off debt fast, you should try to pay more than the minimum payment each month. If you only pay the minimum, it’ll unfortunately make the process a lot longer since most of that payment is going towards the interest rate. Even the smallest bit more is better than the minimum.

If you can’t afford to pay a little extra, try to at least make the minimum payment so you don’t get hit with late fees. It’ll help keep your account in good standing.

5. Plan a monthly budget

Creating a monthly budget will ensure you can afford your monthly expenses. Before you start planning, it’s a good idea to track your spending for at least a month. This will help you identify areas where you could be cutting expenses and saving more. For example, cut your daily coffee run to Starbucks and make coffee from home. You’d be surprised how much money will go back in your pocket.

In theory, it’s a good idea to spend less than your budget. Although you set a specific budget you can afford, any “leftover” money could be put towards your debt as additional payments. While you’re at it, try to take things out of your budget when they aren’t needed, like reducing your takeout orders or cancelling non-essential subscriptions.

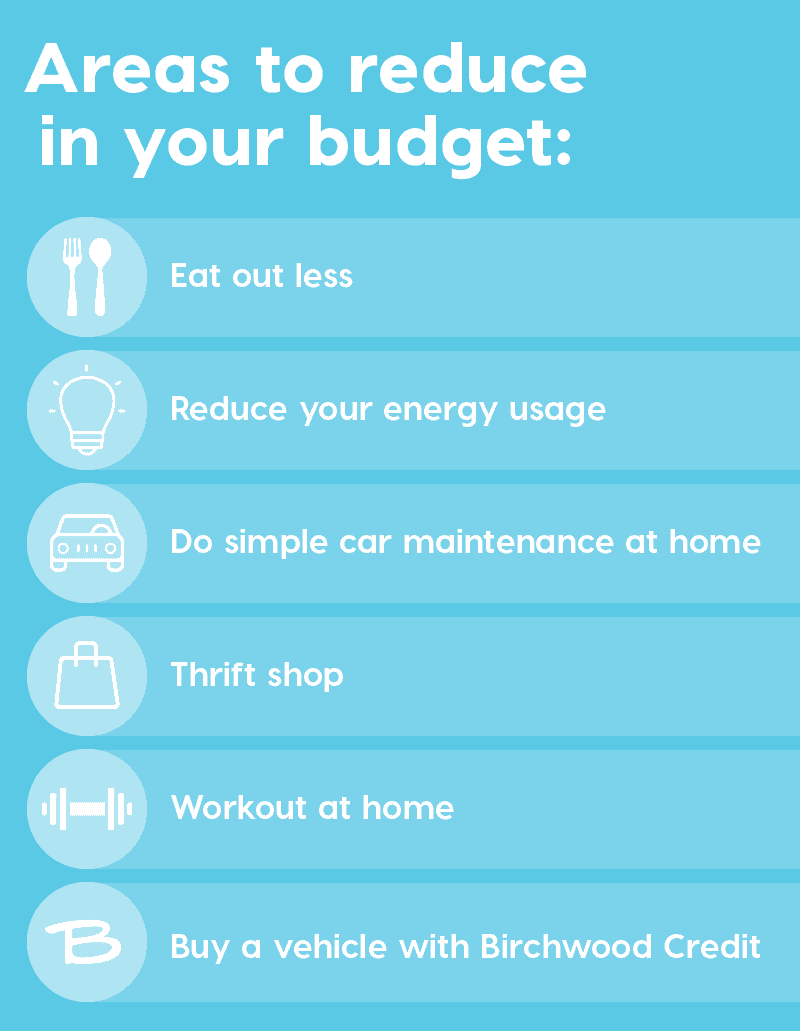

Ways to cut costs in your budget:

- Eat out less

- Reduce your energy usage

- Do simple car maintenance at home

- Thrift shop

- Workout at home

- Buy a vehicle with Birchwood Credit

Even if it’s difficult, try not to purchase unnecessary things if you don’t have the money for it. Don’t forget to treat yourself every once in a while, but don’t buy non-essential items if it’s going to add to your existing debt. Your budget is here to help you manage that additional spending, so leave some room if you’d like to treat yourself now and then.

6. Find an extra income source

The economy is not at its strongest right now, but if you’re able, another way you can pay off your debt is by getting a second job or picking up extra shifts at your current one. With the money you make from this additional income, apply it to tackling your debt. It’ll help speed up your debt relief process.

If you can’t find another job or don’t have the time, try selling things you don’t need around your home. Any little bit of extra money you put towards your debt will help you pay it off faster.

7. See a credit counsellor

Another way to get your debt under control is by seeing a credit counsellor. They’ll help you get back on your financial feet and explain the ways you can start tackling your debt.

Some organizations offer free credit counselling to set up a path specifically for you based on your debt history. They’ll give you the tools you need so you can become debt free and stay there. These tools include budgets, debt consolidation, debt management plays and creditor negotiation.

It’s important to recognize when you need help. If you feel like you’re drowning in your debt, don’t be afraid to ask for additional support. It can make the whole process more manageable.

8. Get a consolidation loan

Talk to your credit counsellor or bank to see if you can set up a consolidation loan. A debt consolidation loan is a single loan you use to pay off all your other debts. This avenue is a strategic way to solve debt problems as you only have to make one payment toward your collective debt (and it’s typically at a lower interest rate).

9. Lower your interest rates

Interest rates can feel like a burden when you’re trying to get out of debt. If you can, try lowering your interest rate.

Credit cards typically have the highest interest rates, but there are some credit and rewards cards out there that start at a 0% interest rate. Keep in mind the more you owe, the higher your interest rate will typically be.

Remember that everyone has a different story and it’s okay if you can’t apply all these tips to your debt situation. Try as many as you can. The more you use, the faster you’ll see debt relief.

Debt relief takes time

Getting out of debt takes time and dedication. Even if it seems challenging, try your best to address it before it gets worse. Collect all your information and set a payment plan with a budget. Meet your minimum payments but strive for more. Focus on your largest debt first and go from there. If you’re looking for extra support, reach out to a credit counsellor or our team at Birchwood Credit. We’re here as a resource to help you tackle your debt and improve your credit.

How Birchwood Credit can help

If you’re looking to rebuild your credit by making vehicle payments, our credit experts will help you get into a vehicle with an affordable payment plan. Even with less than perfect credit, we can help you get approved.

Our goal is to create a payment plan that fits your budget and lifestyle. We want to help you and show you how to manage debt problems. We’ll start with a Secure Credit Check to evaluate your credit situation and assess how much you can afford to spend on a vehicle. From there we’ll make a payment plan and get you on track to financial independence.

Fill out an online Car Loan Application to get started with one of our experts today.