How to Check Your Credit Score 101

If you’ve ever bought a car or a house, attended a post-secondary institution with a student loan or if you actively use a credit card, you’ve borrowed money and taken on debt. When you take on debt, you use credit and you’re given a credit score based on your credit activity. This score helps lenders determine if you’re a reliable borrower.

Millions of people across Canada have credit reports that record their credit history but many Canadians have never checked them. Knowing your credit score is your first step towards rebuilding credit and working towards your financial goals. We’ll go over how to check your credit score so you can know where you stand and start improving your credit.

What is a credit score?

A credit score is a three-digit number between 300 and 900 that represents your credit risk. Your credit risk is the likelihood that you’ll pay your bills on time, or pay back a loan on the terms agreed upon. The higher your credit score, the lower your lending risk, which means more lenders will want to approve you for new credit.

Read our blog post to learn what is the average credit score in Canada by age including credit ranges, factors that impact your credit score and ways to build good credit.

What is a credit report?

A credit report is a record of a borrower’s credit history including active loans, payment history, credit limit and how much they still owe on each of their loans. Your credit activity, which is found on your credit report, impacts your credit score.

How to check your credit score in Canada

There are two national credit bureaus in Canada: Equifax and TransUnion. Once a year, you can request a free copy of your credit report by mail though if you want instant results online, it’ll cost you.

There are five steps to checking your credit report:

- Step 1: Choose a credit bureau

- Step 2: Provide your identification

- Step 3: Decide how to receive your credit report

- Step 4: Understand your credit report

- Step 5: Monitor your credit score monthly

Step 1: Choose a credit bureau

Under Canadian law, you’re entitled to a free copy of your credit report once a year. You can receive it by mail, in-person or online (but we’ll talk more about that later). So which credit bureau do you go with?

Both. Here’s why.

Your credit report will have minor changes from one credit bureau to the next, since every bureau, financial institution and lender uses a different model to determine your credit score.

For example, TransUnion may weigh “payment history” as 35% of your credit score whereas Equifax may weigh it as 40%. This is just an example but it shows how evaluation systems may differ. Getting a credit report from both bureaus will give you the full picture and ensure you’re well informed before you apply for a loan. It’s a good idea to get them at different times of the year so you can monitor your spending habits.

Will checking my report from a bureau affect my credit score?

Your credit score will not be affected when you request your credit report but be mindful of websites and apps that claim to check your score without affecting it. There are some credible third-party websites such as Bankrate and Borrowell, but many sites are scams. Anytime an unauthorized site asks for personal information such as your SIN number, it will show up on your credit report and your information may be compromised.

Check out our blog post to learn how credit checks impact your credit score and the differences between soft and hard inquiries.

Step 2: Provide your identification

You have two options when it comes to getting your credit report: you can get one for free, or you can pay for instant results. Let’s look at the type of identification you need for both options.

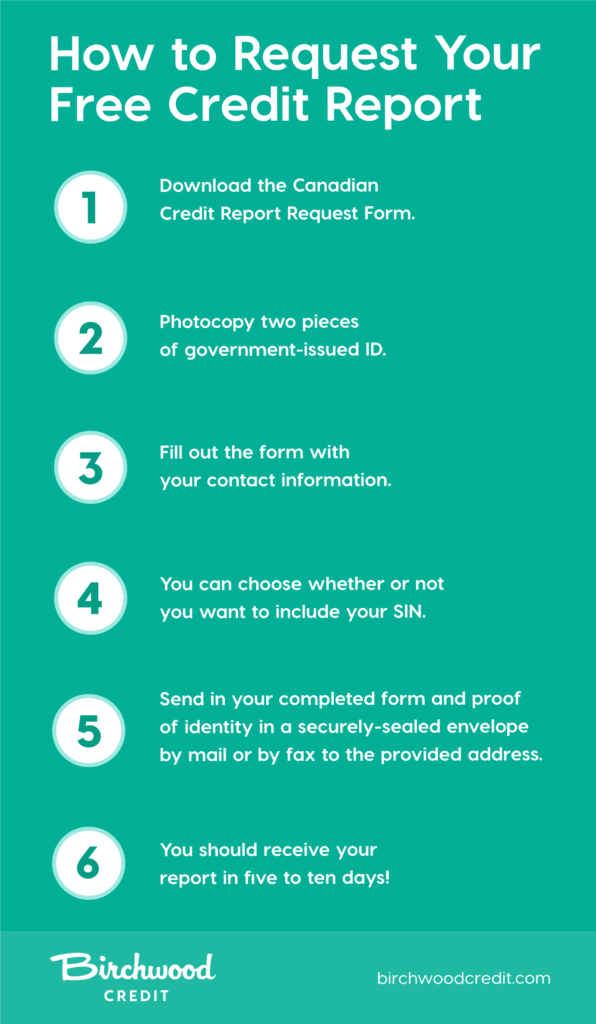

How to get your free credit report

- Download the Canadian Credit Report Request Form.

- Photocopy two pieces of government-issued ID (e.g. driver’s license, health card, birth certificate, passport)

- If your address is not up-to-date on either piece of identification, you can use a bank statement or telephone bill. The credit bureaus recommend you black out transactional details.

- Fill out the form with your contact information.

- You can choose whether or not you want to include your SIN but we recommend you provide it. This allows the bureaus to cross-reference your information which prevents delays and confusion, ultimately speeding up the process.

- Send in your completed form and proof of identity in a securely-sealed envelope by mail or by fax to the provided address.

- You should receive your report in five to ten days!

How to get your paid credit report

If you pay for your credit report, you get your results much faster. You might opt to pay for your report if:

- You’ve already received your free annual report

- You’re looking for a more in-depth credit report (which isn’t provided with the free option)

- You’re wanting to cross-reference your report as it had noticeably different scores from each bureau

It’s important to remember your credit report and your credit score are two different things. Your credit score is a three-digit number which lenders use to determine your creditworthiness. You can read our five reasons why you should check your credit score.

On the other hand, your credit report contains your borrowing history (which impacts your credit score). We suggest utilizing your free credit report – the only time you’d really need to pay for another one is if you’re in a poor credit situation and are working on rebuilding it.

If you decide to pay for your credit report, you’ll follow the same process as the free report but with this extra step:

- Include your credit card information at the bottom of the Canadian Credit Report Request Form.

Decide how to receive your credit report

There are three ways you can receive your credit report:

- By mail, either by:

- Filling out the online form explained in the previous step

- Ordering your report by phone. A representative will ask you to confirm your identity by answering a few personal questions, then you’ll receive it in the mail within 1-2 weeks.

- In person. When you request your credit report in person, you can receive it the same day. Equifax and TransUnion have offices located throughout Canada, although neither bureau has an office in Manitoba.

- Online. This is arguably the most convenient avenue because you’ll have immediate access to your credit report (though you’ll have to pay for it).

Step 4: Understand your credit report

The major credit bureaus refer to credit reports in different ways:

- Equifax refers to your credit report as credit file disclosure

- TransUnion refers to your credit report as consumer disclosure

It’s normal to feel overwhelmed when you receive your credit report. There’s a lot of information to decipher, which is why we’re here to help you work through it. Our blogs What is the Average Credit Score in Canada by Age and Credit Score Ranges in Canada Explained may help you understand your credit score ranges and what your credit score means.

It’s important to understand what each letter and number on your credit report means. They act as a code for lenders to explain how well you repay your loans.

These codes have two parts:

- The letter shows the type of credit you’re using

- The number shows when you make payments

You can check out the Financial Consumer Agency of Canada’s guide to understanding your credit report for more information.

Step 5: Monitor your credit score monthly

Many organizations offer credit monitoring services which is great if you’re concerned about fraud/identity theft or simply want to improve your credit score quickly. While credit monitoring will identify fraud, you won’t be able to stop it from happening.

Monitoring also comes at an additional cost. Equifax and TransUnion offer credit monitoring for around $20 per month. Make sure you consider the pros and cons before signing up, as credit monitoring doesn’t come cheap. You still get your free report from each credit bureau which will help you stay on top of your credit history, and if needed, you can always pay for instant online access. Ultimately, the choice is yours.

Repair your credit with Birchwood Credit

Understanding your credit score is an important part of rebuilding your credit and achieving financial independence. If you don’t know what your credit score is, you’re not alone. Our guide, Rebuilding and Repairing Your Credit Score, will help you learn more about your credit score, how it works and how you can rebuild it if it’s not where you’d like it to be.

Download the guide today and take the first step in improving your financial health.

If you need a new vehicle and are looking for an affordable payment plan, our credit experts are ready to help you, even if you have bad credit. You can fill out an online Car Loan Application and our credit experts will help you find a payment plan that meets your budget and lifestyle. You can also reach out for a complimentary credit check.

Our offices have reopened, though if you’d prefer to shop from the comfort of your home, you still can with our Buy From Home program. Your entire buying experience will be 100% contactless from the loan approval and vehicle shopping to the test drive and delivery. You’ll even get a $1000 rebate and other added benefits. Visit our Buy From Home page for more information.