The True Cost of Borrowing

Every time you borrow money, you incur debt. Although the word usually comes with negative connotations, taking on debt isn’t always a bad thing. Borrowing allows us to build our credit score and prove we are reliable borrowers. It also allows us to make major life purchases like a new car or house.

There’s a lot more to borrowing money than just the loan. We’ll walk you through the true cost of borrowing including everything from the type and amount of loan to the interest rate, loan term, and additional fees.

But first, what really is the true cost of borrowing?

The cost of borrowing

When you borrow money, you take out a loan. In basic terms, the total cost of a loan is the amount of money you borrow plus the interest you pay on top of that. But it’s not that simple.

How do you calculate the interest?

That’s where the annual percentage rate (APR) comes in. APR is recognized and calculated as the cost of borrowing for a loan. APR is the interest rate plus the cost of any fees averaged out over the length of the loan. It depicts the actual interest rate charged on your loan because it accounts for all the extra fees (if any) that you’ve incurred through borrowing the principal. The principal is the total amount borrowed (the loan) that does not include the cost of borrowing.

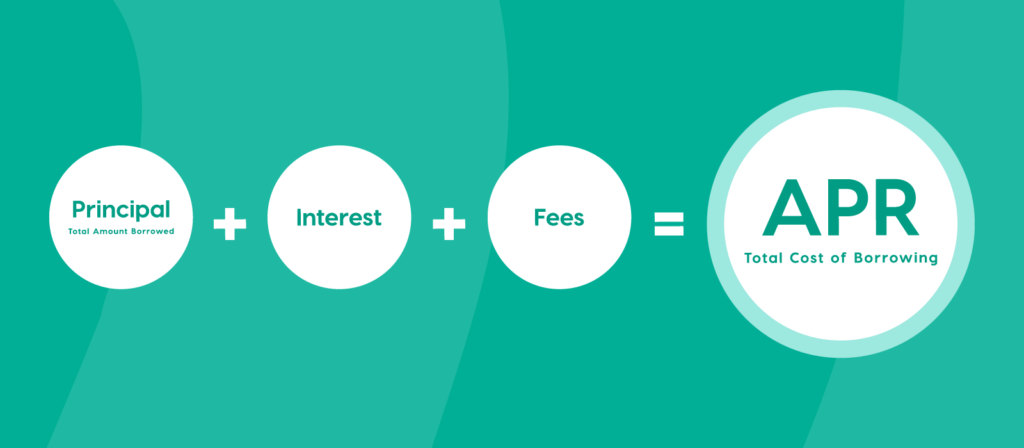

Here’s a simplified way of looking at it:

Principal (Total Amount Borrowed) + Interest + Fees = APR (Total Cost of Borrowing)

What this shows is there’s more to loans than just interest rates. If you have outstanding payments on the principal of the loan at the end of each period (meaning you’ve missed payments), your interest will increase. There are many factors at play when calculating the true cost of borrowing but generally speaking, the lower your APR, the lower your monthly payments should be. Ideally, you will spend less in the long run.

How APR (the cost of borrowing) is calculated

If APR were a puzzle, it would have many pieces. There are plenty of factors that come into play when calculating the cost of borrowing. Here are the top five you should look out for.

1. Type of loan product

The cost of borrowing will change depending on the type of loan product you’re borrowing for.

Here are some popular loan products:

- Car loan

- Credit card

- Mortgage

- Personal loan

- Business loan

- Line of credit

When it comes to mortgages and some other loans, lenders use the “remaining balance method.” They multiply the interest rate by the principal balance (loan amount) at the start of the term and each payment includes some of the principal amount. With these types of loans, you won’t pay interest on the principal you have already repa

When it comes to mortgages and some other loans, lenders use the “remaining balance method.” They multiply the interest rate by the principal balance (loan amount) at the start of the term and each payment includes some of the principal amount. With these types of loans, you won’t pay interest on the principal you have already repa

For cash advances and balance transfers, you’re charged interest from the day you made the transaction until the day you repay the amount in full.

The cost of borrowing varies depending on the type of loan you take out, so it’s important to ask about the total interest and fees or extra charges. For details on APR calculations, check out this guide from the Government of Canada.

2. Amount of money borrowed

The amount of money you borrow will impact the total cost of borrowing. The larger the loan, the longer you’ll have monthly payments which typically means you’ll incur more interest each month (and more interest total). If you can afford to, it may be more cost-effective to have a shorter loan term and larger monthly payments. This will help you pay off the loan faster and you won’t have to pay as much interest.

3. Interest rate

The interest rate has a large impact on the total cost of borrowing. The higher your interest rate, the more you’ll pay, and the higher the cost of borrowing will be. It also depends on the type of interest rate you have.

- Fixed interest rate. When you have a fixed interest rate, the rate will remain the same for the duration of the loan.

- Variable interest rate. When you have a variable interest rate, the rate will fluctuate depending on the interest rate released from big banks. As the “overarching” interest rate changes, so will yours.

Fixed interest rates tend to be the more favourable option as you’ll know what you’re signing on for. Either way, it will impact your total cost of borrowing.

4. Loan term

The loan term is the amount of time you have to pay the loan off. If you have a longer loan term, you’ll have lower monthly payments but the cost of borrowing is higher – this is because you’ll pay more interest in the long term.

If you can afford to, paying off a loan quicker (even if you have higher monthly payments) will help you save on interest and you’ll ultimately spend less at the end of the day.

5. Fees and penalties

Not all loan terms are clearly communicated so in order to know the true cost of borrowing, it’s a good idea to ask the lender about any extra fees or hidden charges that come with the loan. Some of these fees may be late payment fees, annual fees, application fees, or prepayment fees. If you ask before you sign, you’ll be more informed and have a better idea of what you’ll be paying for.

If you’re planning on taking on a loan, you can try this loan calculator to estimate the true cost of borrowing by entering the total loan amount, the loan APR, monthly payment, and length.

At the end of the day, some debt is unavoidable. Many of us use credit cards and eventually want to purchase a home or a vehicle. The key is to be well informed when taking on new debt so you know the true cost of borrowing and feel comfortable with the loan agreement.

At Birchwood Credit, we want to help you get into a new vehicle, even if you have bad credit. You can try our online Car Loan Calculator and adjust your loan duration and loan payment so you can estimate how much you need to budget for monthly payments.

For any questions about our process or how to get started, contact our credit experts and they’ll be happy to help you.