The Best Car Payment Calculator in Manitoba: Quick and Free Estimate

You’re ready to buy a new vehicle – very exciting! Before you start shopping, it’s important to know how much you can afford to spend while still budgeting for your other expenses.

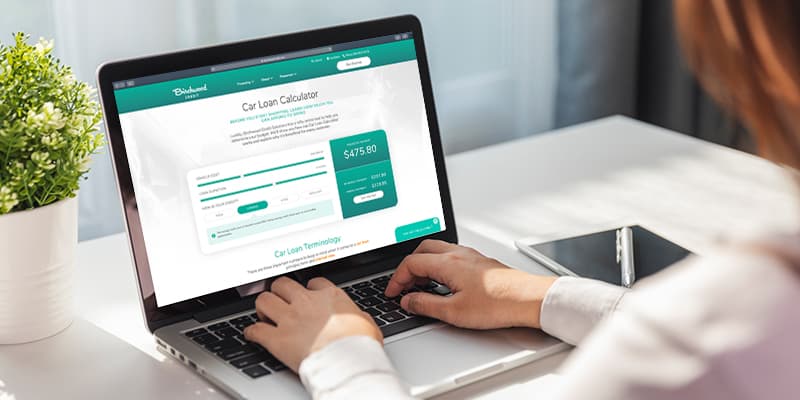

Our team at Birchwood Credit created one of the best car payment calculators in Manitoba that will help you budget for a vehicle that fits your lifestyle. Learn how our calculator works and how you can use it to create a budget that works for you.

Click here to use our calculator!

Car loan terminology: principal, term and interest rate

Before we explain how the car loan calculator works, there are three car loan terms we should cover:

- Principal. This is the total cost of the vehicle, including taxes, loan administration fees and add-ons. It’s the lump sum of money you borrow to pay for a new vehicle.

- Term. The term is the length of time that payments must be made on the loan. Loan terms usually average from 36 to 72 months.

- Interest rate. This is the percentage the lender is charging you to borrow the principal, or the sum of money to pay for the vehicle.

These three elements work together to produce a monthly payment for your vehicle. We’ll dive into how they interact in our car loan calculator.

How our Manitoba car payment calculator works

Our Car Loan Calculator is easy to use, especially as a tool for budgeting. It’ll give you estimated weekly, bi-weekly and monthly payments so you can evaluate how much car you can realistically afford.

The calculator has three parts you can adjust online. They are as follows:

Part 1: Vehicle Cost

You can adjust the vehicle cost to see how much your payment estimates would change given the price of the vehicle. This number represents your principal. You can adjust it from $5000 all the way up to $50,000.

Part 2: Loan Duration

In this section of the calculator, you can adjust the amount of time you’d like to pay off your loan. This represents your loan term. Every time you adjust the loan term, it’ll affect your monthly payment and show your estimated payment options.

Part 3: Your Credit

Your credit helps determine the interest rate and payment plan you get when you purchase a vehicle. The interest rate is the fee you pay for borrowing the principal (the full amount of your vehicle). The better your credit, the lower (better) your interest rate. If you don’t know your credit, it’s alright – just play around with the different options to see how it affects the monthly payment.

Interest rates and how they’re affected by your credit

Your interest rate is determined based on your credit score and creditworthiness. Your credit score is a three-digit number that represents your reliability as a borrower. Credit scores range from 300 (poor) to 900 (excellent) and generally speaking, people with a credit score in the mid 600s should be approved for new credit and get a better interest rate. This is because they’re viewed as a reliable borrower.

That being said, if you have less than perfect credit, you can still be approved for a car loan with Birchwood Credit. We look at your entire financial situation including your annual income, job stability and payment history. We don’t make our decisions solely on credit score – we approve all credit types and take your financial situation into account when calculating your interest rate and payment terms.

Our in-house financing is something that differentiates us from big banks and allows us to help more customers. Since we truly lend our own money, we offer better rates, payment terms and loan options. While banks and other institutions may turn down applications based solely on your credit score, we work with you and consider your entire financial situation when making a decision. We’ll find you a payment plan that works with your budget and lifestyle so you get into a nice vehicle that you can actually afford.

Why budget?

While many of us would enjoy a car with all the bells and whistles, it doesn’t always make sense financially. It’s super important to create a budget before purchasing (and even searching) for a new vehicle. Knowing how much money you have to work with will help you set realistic expectations and not be disappointed if you have to sacrifice some features.

Here are some things to consider when you begin budgeting.

- Should I buy new or used? If you have less to work with, maybe purchasing used is a better option for you. New vehicles are more expensive and depreciate quicker than used cars, although you’re covered under warranty. When you buy used, you run the risk of spending more on maintenance and repairs. Whichever avenue you take, make sure you consider both the pros and cons.

- Can I afford a down payment? The more you pay up front, the less you’ll pay in interest and the lower your car payments will be. It’ll save you money in the long run if you can put a larger sum down right when you buy. This is something you can account for in your budget.

- Have I accounted for maintenance? Even new cars aren’t invincible and will require some routine maintenance. This could be simple costs for gas and oil changes to more pricey procedures like winter tire changes and body work. It’s a good idea to put some money aside for these expenses.

- Do I have some money put away for emergencies? Accidents happen and if you need to pay for any major vehicle repairs, you’ll feel a lot better if you had some savings put aside. Even if you put a little away per month, it’ll add up over time and will be there should you need it!

There’s a lot to account for when you budget for a vehicle, from down payments, maintenance and emergencies – all factored into your other living expenses. We hope our Car Loan Calculator helps you get started. It also may be valuable to research how much car you can afford based on salary. If you’ve prepared a clear budget before you start your search, you’ll be able to search for a defined vehicle demographic that you can both afford and be happy with.

It’s important to do your research before you start your car search. Read on to learn why rates matter, how rates vary by lender, what factors can influence your rate and how you can improve your odds on getting the best car loan interest rates.

Ready to apply? If you purchase a vehicle before the end of December, you’ll take home FREE command start and a $5000 CASH giveaway entry!