5 Reasons Your Credit Score is Important

Worried you can’t afford a loan due to high interest? Wish you didn’t have to put so much money into security deposits? Imagine what you could do with a couple extra hundred dollars every month! That’s what having a good credit score means. Let’s look at some ways a good credit score can better your life!

WHAT IS A GOOD CREDIT SCORE IN CANADA?

According to Equifax, a good credit score falls between 660 and 724. Ultimately it’s up to individual lenders to decide what they consider to be a good score but the following table is a useful guide:

- Poor credit: 300-579

- Fair credit: 580-669

- Good credit: 670-739

- Very good credit: 740-799

- Excellent credit: 800-850

If your score is above 724—congrats! If you fall beneath, don’t worry — you can get there. Here are a few reasons you should strive for a great credit score.

BENEFITS OF GOOD CREDIT SCORES

1. Low-Interest Rates

Good credit saves you money. When your score is high, lenders will charge lower interest rates on credit cards and loans because they feel they can trust you to repay the money you borrow.

In fact, with a score below 600, it’s doubtful you’ll qualify for a mortgage from a bank in Canada.

Some private mortgage lenders will accept all credit scores, but many of them are far more expensive due to interest rates and extra fees.

2. Negotiating Power

Even if you’re already paying high-interest rates, with a better score you’ll be able to negotiate even better ones. In fact, you’ll have the bargaining power to access more creditors.

This negotiating power is especially useful when shopping for a car or home. If you get prequalified/preapproved for loans, you’ll close deals faster than those who don’t, which gives you an edge against other buyers.

3. Landlord Approvals

If you’re not looking for a mortgage and prefer renting, an excellent credit score will still come in handy.

Landlords typically use credit scores to review tenant applications. In their eyes, a high score suggests the tenant will make rent payments on time. This means you’ll have way more options when looking for a new home and will likely get approved for rentals faster!

4. Goodbye, Security Deposits

Both utility hookups and cellphone contracts often require security deposits from those with lower credit scores.

Good credit scores can reduce the costs of security deposits in:

- Cellphone contracts

- Utility hookups

- Apartments

In some cases, people will wait 3–6 months before applying for apartments to improve credit and lower the costs of deposits.

Although people with good credit will likely still pay a damage deposit on a new apartment (albeit a reduced one), those with good credit might not have to pay a deposit whatsoever for the other two departments. Ask your cell provider about their policy — you might just be free of a deposit when it comes time to renew your contract!

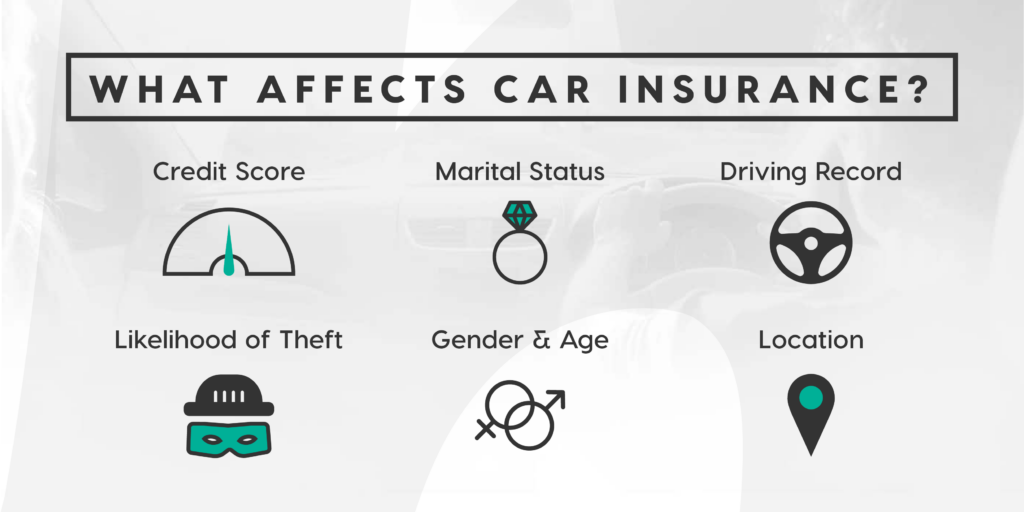

5. Better Car Insurance Rates

When car insurance companies form estimates, they look at many factors, including credit. It’s worth mentioning they do look at other factors, including:

- Occupation

- Location

- Insurance policy options

- Car model

- Age, marital status and gender

- Driving records and claim history

HOW CAN I IMPROVE MY CREDIT SCORE?

There are many ways to improve your credit score, such as not using more than 30% of the credit you have available to you or making full payments toward loans, credit cards, bills and so on.

If you’re looking to build credit, car loans are a great way to do so. Although traditional lenders like banks will charge you lots in interest if you have a lower score, we take a different route.

We believe credit shouldn’t serve as a be-all and end-all. Life happens. We look at your entire financial situation and create a payment plan that works for you. Find out more about our In-House Financing!