Learn What is a Good Credit Score in Canada: Good Credit Explained

When you purchase a vehicle, your credit score has an impact on your payment plan, interest rate and the type of vehicle you’ll be approved for. The higher your credit score, the better price package you’ll ultimately get on your vehicle.

But what is a good credit score in Canada? We’ll break down the ideal credit score for purchasing a vehicle, including how you can still get a car loan with less-than-perfect credit as you continue building your score.

How does your credit score impact your car loan?

Your credit score is a three-digit number between 300 and 900 that represents your credit risk and your reliability as a borrower. Your credit risk is the likelihood you’ll pay your bills on time, or pay back a loan on the terms agreed upon.

In Canada, credit scores range from 300 (very poor) to 900 (excellent) with the average Canadian credit score sitting at 650. According to TransUnion, a score above 650 will likely qualify you for a standard loan, while a score under 650 will likely make it difficult for you to receive new credit.

In simple terms, the higher your credit score, the better rates you’ll get on your car loan. This is because you’re viewed as a reliable borrower. Customers with higher credit scores will typically get better (lower) interest rates which reduces your car payments. However, this doesn’t mean folks with lower credit scores can’t get approved for vehicle financing.

What is the average credit score needed to buy a car?

While most lenders look for customers with a credit score in the mid 600s, there is no single number that guarantees your approval for a car loan. In some cases, lenders look for high credit scores, but others, including our team at Birchwood Credit, approve all credit types.

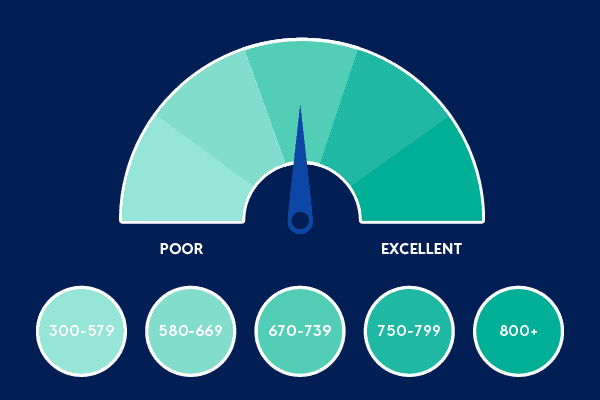

Here is credit bureau Equifax’s breakdown of credit scores and their rating:

- 300-579: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very Good

- 800+: Excellent

While the recommended credit score is around 650 and above, every lender is different and will use different classification systems to decide who is approved and who is denied.

Can I get a car loan if I have a bad credit score?

At Birchwood Credit, yes! We look at your entire financial situation, not just your credit score, and we approve all credit types. We understand the challenges that come with being in a difficult financial situation and are here to help you through the process.

Something that differentiates us from other lenders and allows us to help more customers is our in-house financing. Since we truly lend our own money, we offer better rates, payment terms and loan options. This allows us to accept customers who may not be approved through traditional financial institutions. While banks and other institutions may turn down applications based solely on your credit score, we work with you and consider your entire financial situation when making a decision.

We’ll find a payment plan that works with your budget and lifestyle so you get into a nice vehicle that you can actually afford.

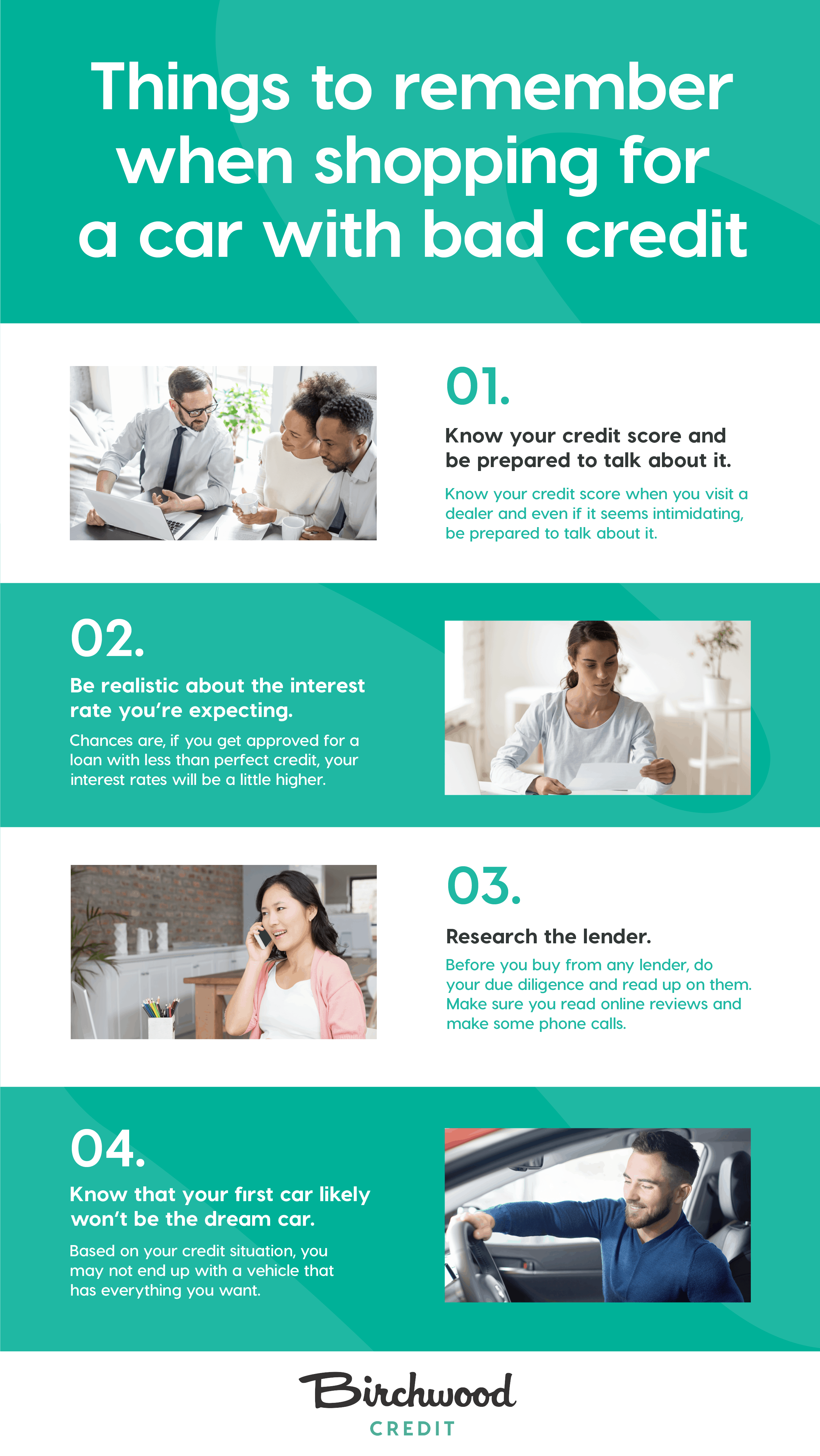

Things to remember when shopping for a car with bad credit

If your credit isn’t where you want it to be, you can still get a vehicle. However, there are some things to keep in mind if you’re shopping around different dealers with a lower credit score.

- Know your credit score and be prepared to talk about it. You should know your credit score when you visit a dealer and even if it seems intimidating, be prepared to talk about it. This gives the lender a chance to get to know you and your situation. They’ll likely ask about other factors including your annual income, how long you’ve been employed in your current role and how long you’ve lived in your home. These elements can speak to your financial stability and payment history.

- Be realistic about the interest rate you’re expecting. Chances are, if you get approved for a loan with less than perfect credit, your interest rates will be a little higher. That being said, you shouldn’t be paying incredibly high interest rates. If you buy through Birchwood Credit, you’ll get a competitive rate close to what a bank would offer.

- Research the lender.Before you buy from any lender, do your due diligence and read up on them. Not all lenders have the best intentions and you’ll want to avoid being taken advantage of if you have low credit. Make sure you read online reviews and make some phone calls in order to find a reliable lender. They can help you answer questions like, should I get a ride with four-wheel drive and so on.

- Know that your first car likely won’t be the dream car. Based on your credit situation, you may not end up with a vehicle that has everything you want. However, once you purchase a vehicle and continue building your credit, you could be eligible for our Upgrade Advantage program and get into a newer vehicle with your first car payment for free. As you continue to rebuild your credit, you’ll have more opportunities to get into a different vehicle.

Ways to improve your credit score before you shop

Life happens, and sometimes unforeseen circumstances may impact your life (and your credit). Job loss, emergency car repairs and other surprise expenses could cause you to dip into your savings and put a hold on your bill payments. Luckily, there are ways to rebuild your credit if you run into financial challenges.

If your goal is to improve your credit before purchasing a new vehicle, here are some simple steps you can take to bump up your score.

- Check your credit score regularly

- Correct errors if they occur

- Use your credit to build your credit

- Make all payments on time

- Increase your credit limit but keep your balance low

- Automate your payments so you never miss them

- Avoid hard inquiries

- Monitor your credit history

Your credit score matters when it comes to car buying. If you have less than perfect credit, you’ll have more opportunities when you work with our team at Birchwood Credit. We’ll help you understand your credit situation and make a plan so you can rebuild your credit and become closer to financial independence. And of course, we’ll help you get into a car you love.

Ready to apply? Get started here!